This is the list of popular Forex Trading brokers in the Philippines

With Easy Deposit and Withdrawal options using Philippines Local Banks and Gcash

1. XM

Trade Forex, Crypto CFDs, Stocks, Metals and More

Anywhere, At Any Time with our XM MT4 & MT5 App

- Over 5,000,000 clients

- Traders from over 190 countries

- 25+ secure payment methods

- 10+ full feature trading platforms

- More than 30 languages supported

- 24/7 customer support

Open XM Account and Get Free $30 Bonus 👉 GET BONUS

2. HFM

HF Markets Group

- 3,500,000 Live Accounts Opened

- HF Brand Established since 2010

- 200+ Employees Globally

- Winner of over 60 Industry Awards

- 27 Supported Languages

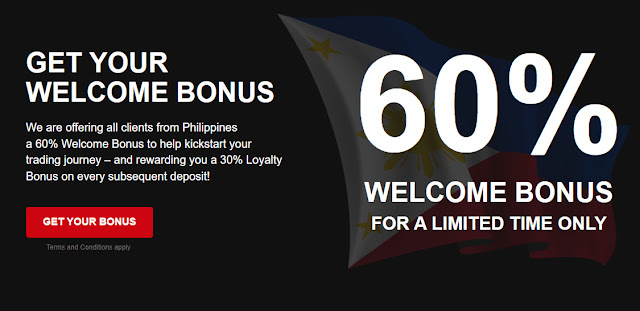

Open HFM Account and Get 60% Welcome Bonus 👉 GET BONUS

3. Vantage Markets

Open Vantage Account and Get 50% Credit Bonus 👉 GET BONUS

4. EXNESS

Online trading with better-than-market conditions

Trade across multiple markets with the most stable and reliable pricing in the industry.

Instant withdrawals, 24/7

Our withdrawals are carried out in seconds with no manual processing, including on weekends.

.jpg)